Nvidia at the Crossroads: U.S.–China Tensions and the Future of AI Chips

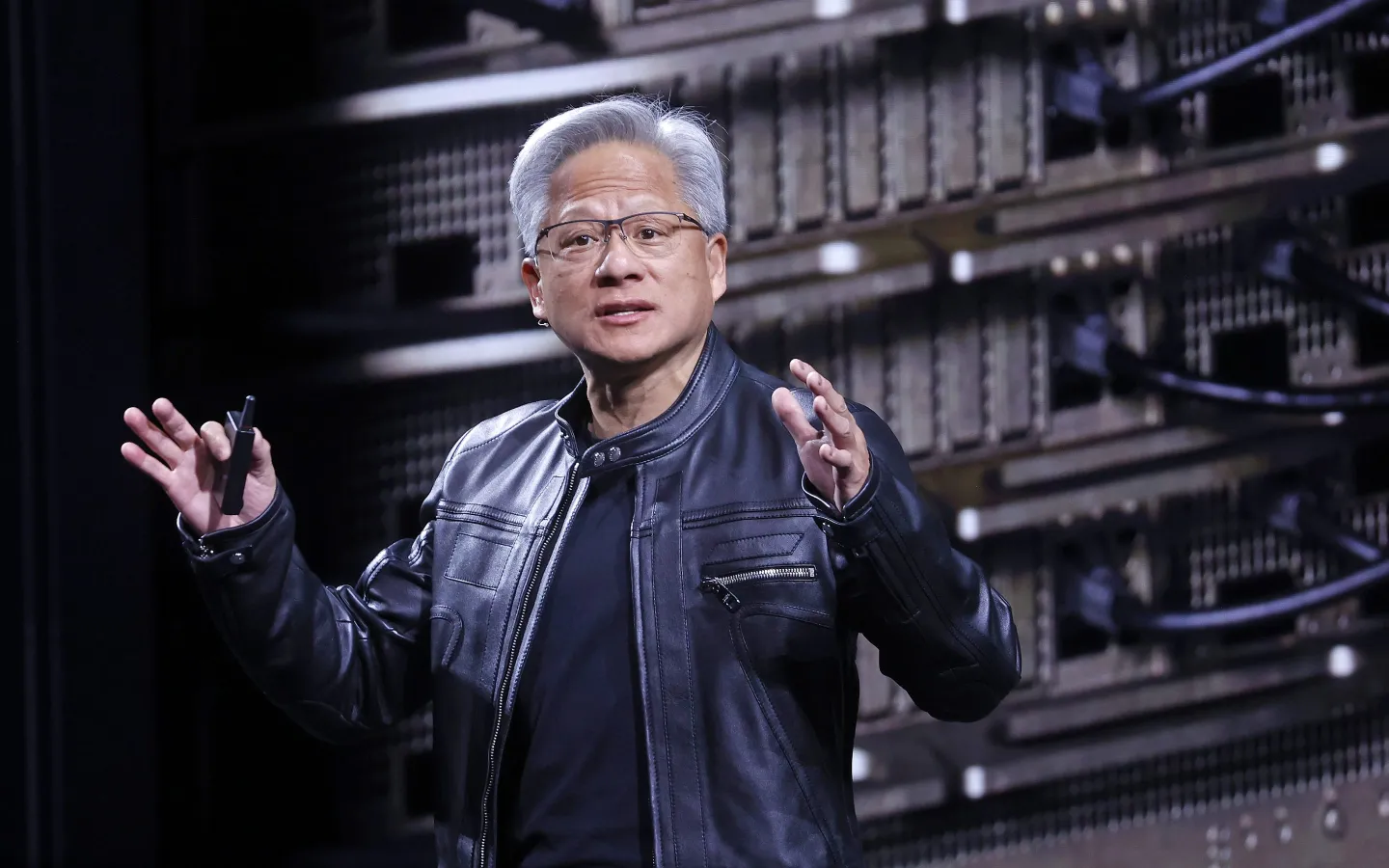

Nvidia CEO Jensen Huang faces U.S.–China tensions as chip sales to China are blocked. Despite short-term risks, U.S. enterprises stand to gain as domestic AI chip leadership accelerates.

Introduction: The Chip Giant in the Crossfire

September 2025 marked a turning point for Nvidia, the company whose graphics processing units (GPUs) have become the backbone of the artificial intelligence revolution. While Nvidia began as a pioneer in computer graphics, its chips now fuel everything from large language models to self-driving cars. The company’s valuation—hovering above $4.2 trillion—reflects not just its dominance in semiconductors, but its central role in shaping the future of AI.

Yet, as the Reuters report revealed, Nvidia’s leadership position comes with geopolitical baggage. The Cyberspace Administration of China (CAC) ordered domestic tech giants like ByteDance and Alibaba to halt purchases of Nvidia’s most advanced GPUs. Simultaneously, U.S. export controls have tightened under the rationale of national security. Nvidia finds itself squeezed between the two largest markets for AI technology.

For executives in the U.S. and abroad, the lesson is stark: technology strategy is now inseparable from geopolitics. Understanding Nvidia’s dilemma is key to anticipating where opportunities and risks will emerge in the next five years.

The Reuters Story: Key Developments

- China’s Regulatory Blockade: The CAC directed Chinese tech firms to cancel purchases of Nvidia’s advanced chips, citing national security and competition concerns.

- CEO Huang’s Response: Jensen Huang acknowledged the turbulence but pointed out that “the U.S. and China have larger agendas to work out.” His words reflected Nvidia’s status as collateral in a broader struggle.

- Stock Market Reaction: Nvidia’s shares fell nearly 3% in a single day. While this may seem small, for a $4.2 trillion company, it represented billions in market capitalization evaporating overnight.

- Chinese Scrutiny: Authorities opened an anti-monopoly investigation into Nvidia’s business practices in China, signaling a more hostile environment.

- Policy Oddities: Earlier, the Trump administration approved a licensing deal that permitted Nvidia to sell limited versions of its H20 chips in China, though this was a narrow carve-out.

- Lobbying Surge in Washington: Nvidia tripled its lobbying spend compared to 2024, seeking influence as export control debates heat up.

- Revenue Exposure: China accounts for around 13% of Nvidia’s total revenue—a substantial amount, though not existential.

These developments illustrate that Nvidia’s role extends far beyond silicon. It is a geopolitical symbol, a proxy for the technological competition between the world’s two largest economies.

Risks for Nvidia and Global Enterprises

For executives, Nvidia’s situation highlights three categories of risk:

1. Financial Risks

- Losing Chinese revenue could slow Nvidia’s growth trajectory.

- Shareholder volatility increases when government policies can erase billions overnight.

- Competitors like AMD or new U.S. startups may seize opportunities if Nvidia is distracted by regulatory battles.

2. Operational Risks

- China’s anti-monopoly investigation could restrict Nvidia’s ability to operate freely.

- Export rules complicate supply chain logistics and limit flexibility in serving global customers.

- Nvidia must manage complex licensing arrangements that increase legal exposure.

3. Strategic Risks

- Chinese firms, forced to innovate domestically, could accelerate chip development in the long term.

- Geopolitical instability could make Nvidia less attractive as a global supplier if customers worry about access.

- Public perception risks: companies deploying Nvidia hardware may face scrutiny if supply becomes entangled in politics.

Why the U.S. Market Will Benefit

China’s Gap in Chip Innovation

Even with billions in state funding, China’s semiconductor industry lags behind Nvidia’s most advanced GPUs. The CUDA software ecosystem, optimized libraries, and global developer community make Nvidia chips nearly irreplaceable for cutting-edge AI work. While China’s Huawei and other firms are building alternatives, they remain years behind in performance.

For U.S. enterprises, this means uninterrupted access to superior hardware. Chinese firms will face restrictions, but American companies will continue scaling with the best available tools.

Supply Chain Realignment

The CHIPS and Science Act has spurred billions of dollars in new semiconductor fabs across the United States. Arizona, Texas, and Ohio are becoming new hubs for advanced manufacturing. By 2030, much of Nvidia’s most important production capacity could be closer to home, insulating U.S. enterprises from geopolitical disruptions.

Innovation First, Regulation Second

While the U.S. government has imposed export restrictions, it has also increased subsidies and incentives for domestic adoption. This dual strategy ensures that American enterprises remain first in line for new AI infrastructure. With competitors locked out, U.S. firms enjoy a first-mover advantage.

Financial Market Support

Unlike China, where regulators are curbing purchases, U.S. markets continue to reward Nvidia’s innovation. Investors view Nvidia not just as a chipmaker but as an infrastructure company powering the future of AI. This capital availability further strengthens the U.S. ecosystem.

DGX Insight: Responsible AI Adoption Amid Geopolitical Shifts

At DGX Enterprise AI, we emphasize that adopting AI is no longer a purely technical decision—it is a strategic and geopolitical one. For executives, this requires balancing speed of adoption with responsibility.

Key recommendations:

- Work With Secure Providers: Partner with U.S.-based vendors who can guarantee compliance and continuity.

- Plan for Data Sovereignty: Be mindful of where training data is processed and stored.

- Design for Flexibility: Build workflows that can adapt to supply chain changes or new regulations.

- Educate the Workforce: Employees should understand both the opportunities and risks of AI adoption.

- Engage With Policymakers: Enterprises must advocate for responsible AI frameworks that support innovation without stifling growth.

Positive Outlook: A U.S. AI Renaissance

Looking to 2030, we can envision a positive scenario:

- Nvidia Maintains Leadership: The company continues to set the global standard in AI chips, with Chinese competitors unable to match CUDA’s ecosystem.

- Resilient Supply Chains: Domestic fabs and allied manufacturing reduce reliance on Asia.

- Accelerated Adoption: Healthcare, finance, logistics, and defense enterprises in the U.S. leverage AI at scale.

- Ethical Guardrails: Clear governance frameworks ensure that AI enhances, rather than undermines, trust.

- Workforce Transformation: American workers are reskilled to thrive in AI-augmented roles, preventing social disruption.

In this scenario, current tensions with China act as a catalyst for U.S. innovation, spurring greater investment, security, and adoption.

Executive Playbook

- Accelerate AI Investment: Don’t wait for geopolitical clarity. Secure infrastructure now to gain a lead.

- Prioritize U.S. Vendors: Align with suppliers embedded in the U.S. and allied ecosystems.

- Develop Workforce Programs: Reskilling must move in parallel with AI adoption.

- Track Regulatory Signals: Stay ahead of policy changes that affect procurement and compliance.

- Think Beyond Efficiency: Use AI not only for cost-savings but as a driver of entirely new business models.

Conclusion: Nvidia’s Crossroads Is America’s Opportunity

Nvidia may be caught in the crossfire of U.S.–China tensions, but the larger story is one of opportunity for American enterprises. By denying China access to cutting-edge GPUs, the U.S. preserves a critical technological lead. With domestic supply chains strengthening and policy incentives aligned, American businesses are positioned to benefit disproportionately from the AI revolution.

For executives, the takeaway is clear: AI adoption is not optional. It is the next competitive frontier. And thanks to current dynamics, U.S. enterprises are better positioned than ever to capture its value.

Ready to transform your enterprise with DGX AI agents and infrastructure insights? Get Started today.